Module Double Entry Accounting

| Accountancy | |

|---|---|

| Numéro/ID du module | 50400 |

| Doc utilisateur du module | This page |

| Doc développeur du module | Module Double Entry Accounting (developer) |

Introduction

The Accounting Advanced module provide double entry accounting features. If you don't need double entry accounting neither editing a ledger, you may use the Module Accounting Simplified instead.

Its features are:

- support for double entry accounting

- grouping transactions in journals

- support for exports (a lot of common software format are supported, and also CSV and FEC format)

Dolibarr provides ready-to-use chart of account for several countries:

- Africa (Benin, Burkina Faso, Cameroon, Central African Republic, Comoros, Congo (Brazzaville), Congo (Kinshasa), Equatorial Guinea, Ghana, Marocco, Niger, Senegal, Tunisia)

- Europe (Belgium, Denmark, Luxembourg, France, Germany, Great Britain, Netherlands, Romania, Switzerland, Spain, Sweden

- South America (Chile)

- And more... (see full list)

Installation

This module is included with the Dolibarr distribution, so there is no need to install it.

Setup

To use this module, you must first enable it using an administrator account, via the menu option "Home - Setup - Modules".

Choose the tab where the module is listed. Then click on "Activate".

The module is now activated.

If a cog icon appears ![]() on module thumb or at end of the line of the module, click on it to access the setup page specific to the module.

on module thumb or at end of the line of the module, click on it to access the setup page specific to the module.

GENERAL

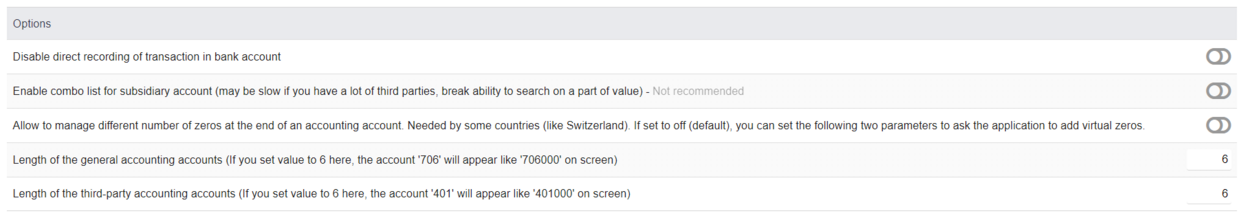

This module's general configuration page allows you to :

Adjust global options

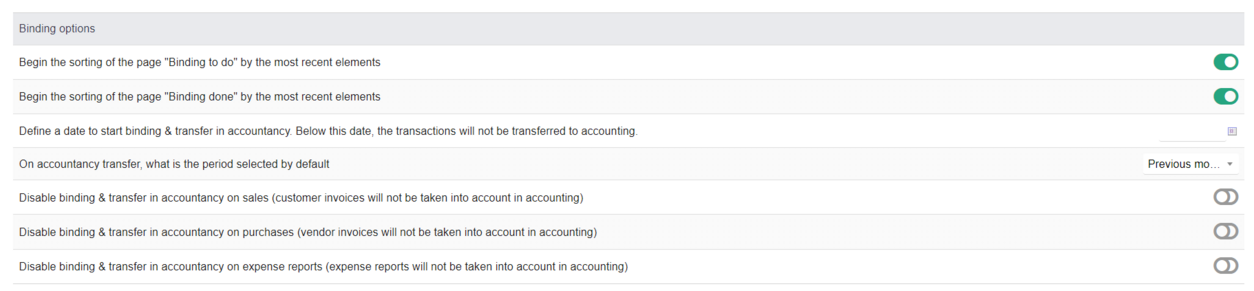

Adjust binding options

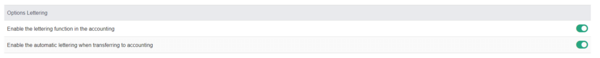

Activate the accounting lettering function

Lettering allows you to associate entries from the same account. In dolibarr, lettering can be used for customer or supplier account only.

For v2 lettering (as it's known internally), it currently only works on sub-ledger accounts. It is planned to work on an evolution (lettering v3) to take over G/L account lettering on the accounts you define.

Lettering V2 feature requires version 17.0.3 of Dolibarr to activate lettering :

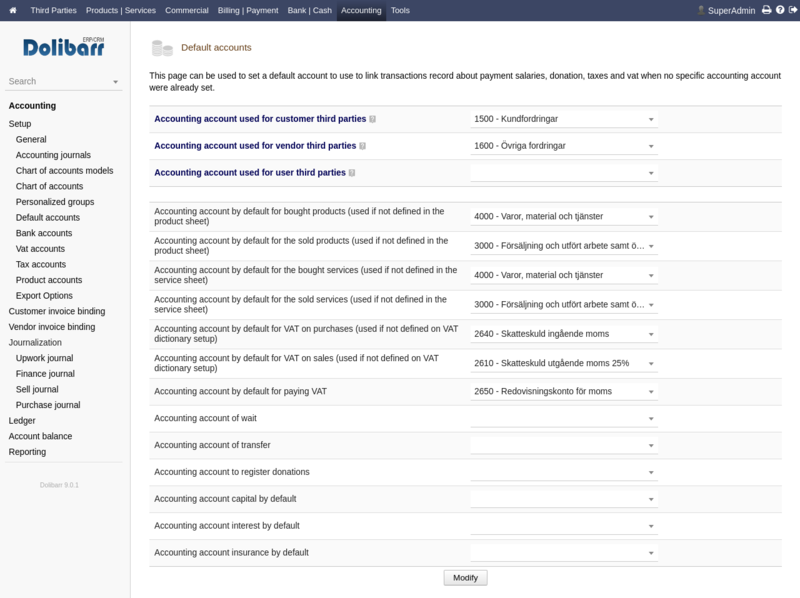

Default accounts

After setting up your chart of accounts you have to tell Dolibarr to use them.

Warning: Make sure you have different accounts for the top 3 accounts from the ones at the bottom or else all the reports will be mixed/wrong.

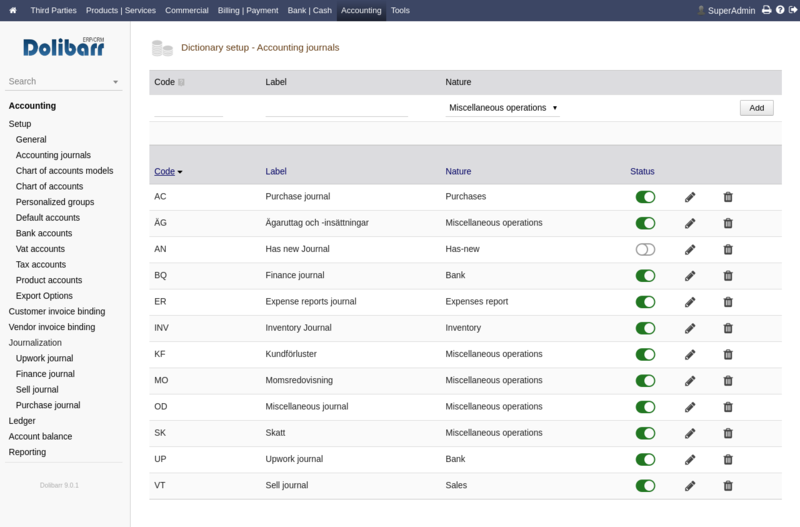

Journals

Set up your custom journals. Here is an example including a special journal for Upwork "bank" account, taxes and an equity insert/take out.

VAT accounts

Setup the applicable VAT rates and accounts for your country.

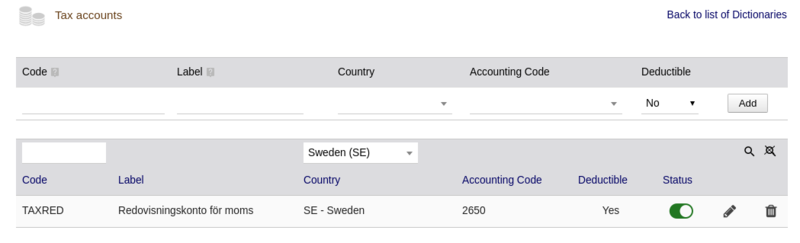

Tax accounts

Setup the account from which you pay your tax.

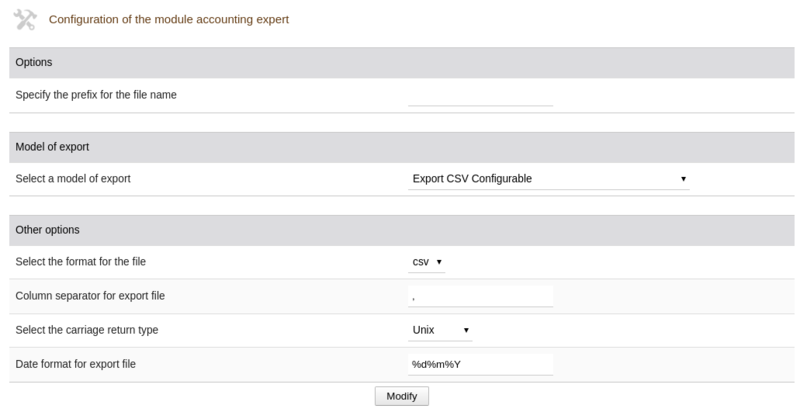

Export options

Change these if needed.

Life cycle / Business rules

Usage of the accountancy module is done in several step:

The following actions are usually executed one time only, or once per year...

- STEP 1: Create a model of chart of account from menu Financial-Accountancy-Setup-Chart of accounts models

- STEP 2: Create or check content of your chart of account from menu Financial-Accountancy-Setup-Chart of accounts

Next steps should be done to save you time in future by suggesting you the correct default accounting account when making thee journalization (writing record in Journals and General ledger)

- STEP 3: Check the default binding between miscellaneous transaction lines and accounting account is done. Complete missing bindings. For this you can use the menu entry Financial-Accountancy-Setup-Default accounts.

- STEP 4: Check the binding between vat rates and accounting account is done. Complete missing bindings. You can set accounting accounts to use for each VAT from page Financial-Accountancy-Setup-Vat accounts.

- STEP 5: Check the binding between special expences (miscellaneous taxes) and accounting account is done. Complete missing bindings. For this you can use the menu entry Financial-Accountancy-Setup-Tax accounts.

- STEP 6: Check the binding between type of expense report and accounting account is done. Complete missing bindings. You can set accounting accounts to use for each VAT from page Financial-Accountancy-Setup-Expense report accounts.

- STEP 7: Check the binding between loans payment and accounting account is done. Complete missing bindings. For this you can use the menu entry Financial-Special expenses-Loans or Financial-Accountancy-Setup-Default accounts.

- STEP 8: Check the binding between bank accounts and accounting account is done. Complete missing bindings. For this, go on the card of each financial account. You can start from page Home-Bank/Cash.

- STEP 9: Check the binding between products/services and accounting account is done. Complete missing bindings. For this you can use the menu entry Financial-Accountancy-Setup-Products accounts.

The following actions are usually executed every month, week or day for very large companies...

- STEP 1: Check the binding between existing customer invoice lines and accounting account is done, so application will be able to journalize transactions in General Ledger in one click. Complete missing bindings. For this you can use the menu entry Financial-Accountancy-Customer invoice binding.

- STEP 2: Check the binding between existing supplier invoice lines and accounting account is done, so application will be able to journalize transactions in General Ledger in one click. Complete missing bindings. For this you can use the menu entry Financial-Accountancy-Supplier invoice binding.

- STEP 3: Check the binding between type of expense report and accounting account is done. Complete missing bindings. You can set accounting accounts to use for each VAT from page Financial-Accountancy-Expense report binding.

- STEP 4: Write transactions into the General Ledger. For this, go into each Journal, and click into button "Journalize transactions in General Ledger".

- STEP 5: Add or edit existing transactions and generate reports and exports.

Exports

These are examples of available export formats. Export can be done from the General Ledger:

Export Standard (TSV)

2012016 gérance janvier 2016 (SI1601-0668) 40100000 FGEFFROY 0 1000 ACH 2012016 gérance janvier 2016 (SI1601-0668) 64400000 1000 0 ACH

Export Cador

See Export Standard

Export Cegid

2012016 ACH 40100000 FGEFFROY C 1000 GEFFROY OLIVIER - gérance janvier 2016 - Tiers gérance janvier 2016 (SI1601-0668) 2012016 ACH 64400000 D 1000 GEFFROY OLIVIER - gérance janvier 2016 - Gerance gérance janvier 2016 (SI1601-0668)

Export Sage Coala

02/01/2016 ACH 40100000 1 gérance janvier 2016 (SI1601-0668) 0 1000 E FGEFFROY 02/01/2016 ACH 64400000 1 gérance janvier 2016 (SI1601-0668) 1000 0 E

Export Sage Bob 50

1 02/01/2016 F FGEFFROY 0 1000 GEFFROY OLIVIER - gérance janvie... 1 02/01/2016 G 64400000 1000 0 GEFFROY OLIVIER - gérance janvie...

Export Ciel compta format txt

1 ACH06022017020120161 FGEFFROY gérance janvier 2016 (SI1 1000C GEFFROY OLIVIER - gérance janvier O2003 2 ACH06022017020120161 64400000 gérance janvier 2016 (SI1 1000D GEFFROY OLIVIER - gérance janvier O2003

== Export Quadratus format txt == (File:KB0014530 - Fichier d'entrée ASCII.pdf

)

MFGEFFROYAC00006022017 gérance janvier 2016C+000000001000 000000 1 1 EURACH gérance janvier 2016 (SI1601-0661 M64400000AC00006022017 gérance janvier 2016D+000000001000 000000 1 1 EURACH gérance janvier 2016 (SI1601-0661

Export EBP

10803 2012016 ACH 40100000 40 GEFFROY OLIVIER - gérance janvier 2016 - 1 1000 C 2012016 EUR 10804 2012016 ACH 64400000 64 GEFFROY OLIVIER - gérance janvier 2016 - 1 1000 D 2012016 EUR

Export Cogilog

ACH 2012016 1 40100000 GEFFROY OLIVIER - gérance janvier 2016 - Tiers 2012016 1000 gérance janvier 2016 (SI1601-0668) GEFFROY OLIVIER - gérance janvier 2016 - Tiers ACH 2012016 1 64400000 GEFFROY OLIVIER - gérance janvier 2016 - Gerance 2012016 1000 gérance janvier 2016 (SI1601-0668) GEFFROY OLIVIER - gérance janvier 2016 - Gerance

Export FEC

FEC means Fichier des Écritures Comptables (French law), a TSV file but with the extension "*.txt".

JournalCode JournalLib EcritureNum EcritureDate CompteNum CompteLib CompAuxNum CompAuxLib PieceRef PieceDate EcritureLib Debit Credit EcritureLet DateLet ValidDate Montantdevise Idevise V1 Journal des ventes 134 20191022 411 Clients et Comptes rattachés 411FINCORP Fincorp FC1808-0007 20180821 Fincorp - FC1808-0007 - Compte auxiliaire 10248 0 V1 Journal des ventes 134 20191022 7061 Prestations de services 20% FC1808-0007 20180821 Fincorp - FC1808-0007 - Prestations de services 20% 0 8540 V1 Journal des ventes 134 20191022 44571 Prestations de services 20% FC1808-0007 20180821 Fincorp - FC1808-0007 - TVA 20 % 0 1708 AC Journal des achats 135 20191022 401 Fournisseurs et Comptes rattachés 401DIVERS Divers HA1808-002 20180802 Divers - FF1808021 - Compte auxiliaire 0 32.9 AC Journal des achats 135 20191022 625128 Frais de repas 5.5% HA1808-002 20180802 Divers - FF1808021 - Frais de repas 5.5% 26.92 0 AC Journal des achats 135 20191022 625127 Frais de repas 20% HA1808-002 20180802 Divers - FF1808021 - Frais de repas 20% 3.75 0

Article explaining the FEC format: https://blog.masterfec.fr/fondamentaux-respect-normes-fec