Module Accounting Simplified

| Accountancy | |

|---|---|

| Numéro/ID du module | 10 |

| Doc utilisateur du module | This page |

| Doc développeur du module | Module Accounting (developer) |

Introduction

This module allows you to get simplified accounting reports. If you need to make double entry accounting, or edit a ledger, you shoul duse instead the Module Double Entry Accounting.

Installation

This module is included with the Dolibarr distribution, so there is no need to install it.

Setup

To use this module, you must first enable it using an administrator account, via the menu option "Home - Setup - Modules".

Choose the tab where the module is listed. Then click on "Activate".

The module is now activated.

If a cog icon appears ![]() on module thumb or at end of the line of the module, click on it to access the setup page specific to the module.

on module thumb or at end of the line of the module, click on it to access the setup page specific to the module.

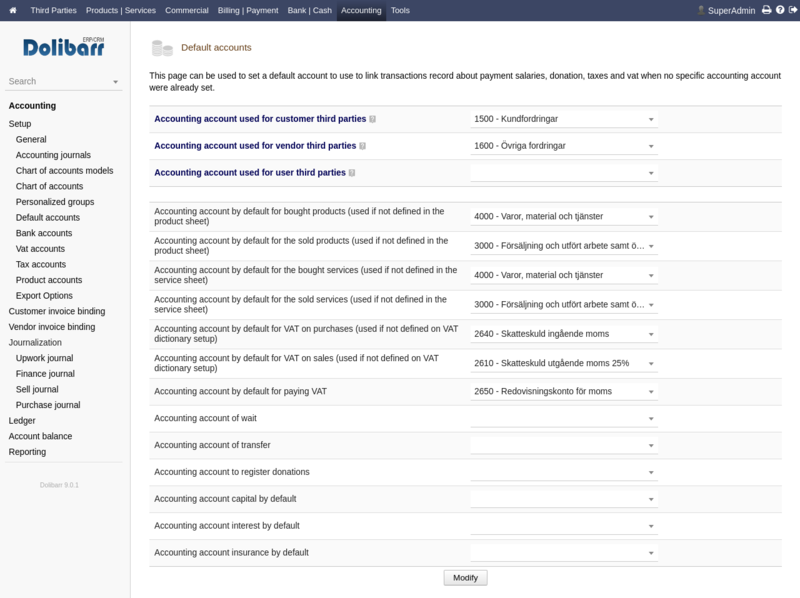

Default accounts

After setting up your chart of accounts you have to tell Dolibarr to use them.

Warning: Make sure you have different accounts for the top 3 accounts from the ones at the bottom or else all the reports will be mixed/wrong.

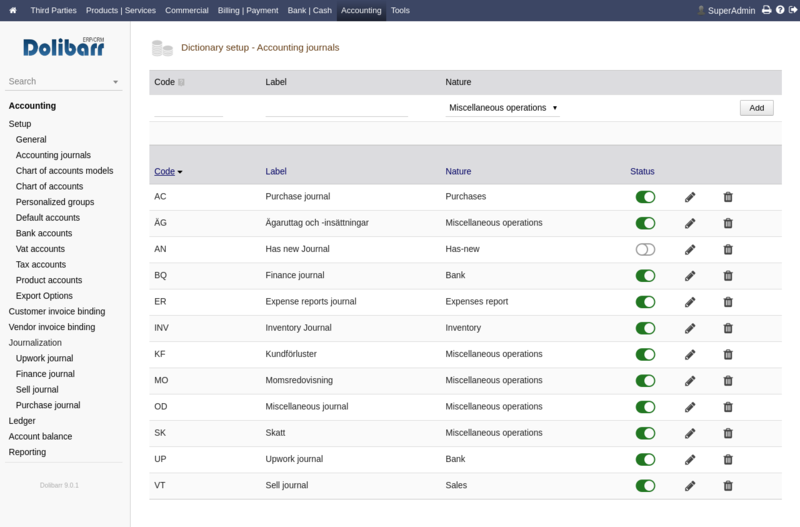

Journals

Set up your custom journals. Here is an example including a special journal for Upwork "bank" account, taxes and an equity insert/take out.

Vat accounts

Setup the applicable vat rates and accounts for your country.

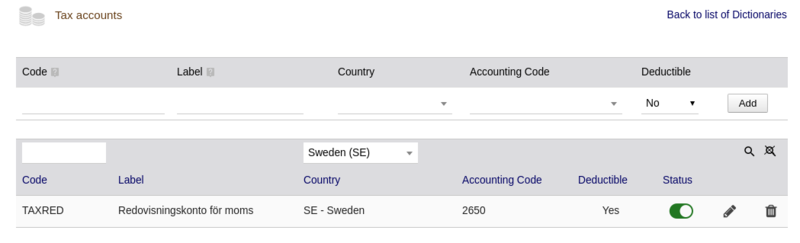

Tax accounts

Setup the account from which you pay your tax.

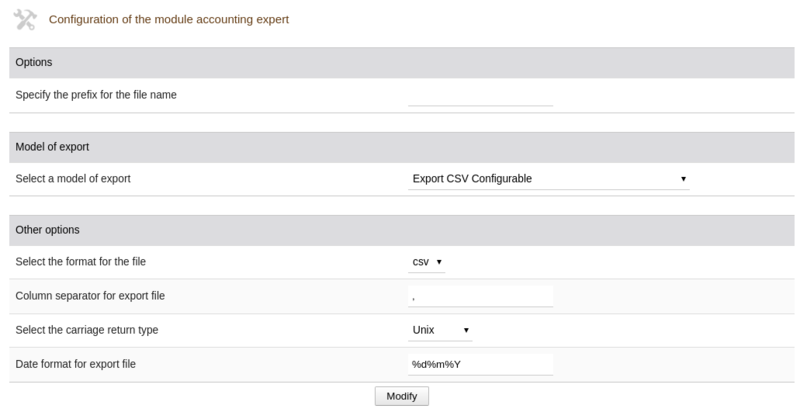

Export options

Change these if needed.

Use

This module contain a ledger that enable you to manually add transactions. However this is not recommended for most transactions.

Transactions from the standard sell and purchase journals can easily be committed to the ledger after they have been assigned valid accounts.

The module also contains a balance sheet for you to see the total income and expense of you company.